CBN Mandates Forex Sellers to Declare Sources

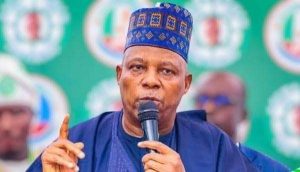

The Central Bank of Nigeria (CBN) has introduced new regulations requiring foreign exchange sellers to Bureau De Change (BDC) of $10,000 and above to declare their sources of forex. This move, announced by Haruna Mustapha, Director of the Financial Policy and Regulation Department at the CBN, aims to curb excesses of BDCs and address uncertainty in the foreign exchange market.

Mustapha highlighted that sellers meeting the specified threshold would also need to comply with all Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) regulations. These guidelines are part of the ongoing reforms to enhance the regulatory framework for BDC operations in Nigeria.

The revised guidelines cover permissible activities, licensing requirements, corporate governance, and AML/CFT provisions for BDCs. They also introduce new record-keeping and reporting requirements to strengthen oversight.

According to the guidelines, only companies licensed by the CBN can operate as BDCs in Nigeria, focusing solely on retail foreign exchange business. The guidelines prohibit banks, financial institutions, and certain government entities from promoting BDCs.

BDCs are permitted to acquire foreign currency from authorized sources, including tourists, diaspora returnees, expatriates, International Money Transfer Operators (IMTOs), embassies, authorized hotels, the Nigerian Foreign Exchange Market (NFEM), and other sources specified by the CBN.

However, BDCs are prohibited from engaging in street trading, maintaining public accounts, accepting assets for safekeeping, or providing deposits or loans to the public in any currency or form. They are also restricted from selling foreign currencies to non-individuals, except for Basic Travel Allowance (BTA), international outward transfers, and certain specified transactions.

These regulatory changes are designed to enhance transparency, combat illegal activities, and ensure the stability of the foreign exchange market in Nigeria. They underscore the CBN’s commitment to implementing robust measures to regulate the financial sector effectively.

TheGuardian News