Cabinet Ministers Convene Emergency Meetings Over Economic Crisis and Soaring Food Prices

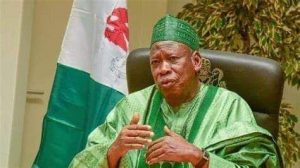

Nigeria’s cabinet ministers have convened urgent meetings to address the country’s economic challenges and the surge in food prices, following mounting pressure on the government in the aftermath of President Bola Ahmed Tinubu’s reforms.

Protests erupted in northern Niger state on Monday, where demonstrators, predominantly women and youths, barricaded a major road in the state capital, Minna, demanding assistance to cope with the rising cost of living.

Since assuming office in May, Tinubu has abolished fuel subsidies and lifted currency controls, resulting in a threefold increase in petrol prices and a sharp rise in living expenses due to the steep depreciation of the naira against the dollar.

The meetings, which commenced on Tuesday, saw the participation of key ministers including finance, information, budget and national planning, agriculture, as well as the national security advisor, the director of the central bank, and other senior aides.

Speaking to reporters, Information Minister Mohammed Idris stated, “By the time these meetings are concluded, we’ll be able to issue a definitive statement on the government’s stance in this matter. All I can say is that discussions are ongoing, and a solution for Nigerians is imminent.”

Ministerial meetings scheduled for Wednesday and Thursday were announced as Tinubu returned to Nigeria after a brief private visit to France.

Government officials have repeatedly urged Nigerians to exercise patience regarding the reforms, which Tinubu asserts will attract more foreign investment to Africa’s largest economy.

However, the immediate impact has been harsh on Nigerians, with inflation reaching 28.92 percent in December, and food prices soaring by 33.93 percent, according to the national bureau of statistics.

The naira has depreciated rapidly against the US dollar since the government scrapped a multi-tier exchange rate system and freed the local currency. Prior to the reforms, the naira traded at around 450 to the dollar, but on Monday, it was trading at 1,400 to the greenback, according to the central bank, nearing the rate on the parallel black market.

The weakened naira has made imported goods more expensive, as businesses now pay higher prices for the dollars needed to import goods into the country.

In a research note, the Economist Intelligence Unit (EIU) stated that the central bank effectively devalued the naira last week, which could stimulate investment. However, it expressed concerns that the country’s foreign reserves would remain under pressure.

As Africa’s largest oil producer, Nigeria has long grappled with foreign currency shortages due to its lagging petroleum output and cautious foreign investors.

“We believe the improvement will take time to materialize, and Nigeria will still need an IMF program,” the EIU note stated regarding the naira. “The currency is now trading close to the parallel market rate. This alone will not encourage significant inflows of hard currency without oil industry reforms and other policy measures.”

Vanguard News