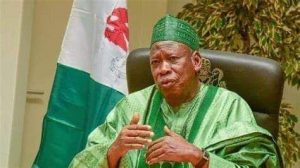

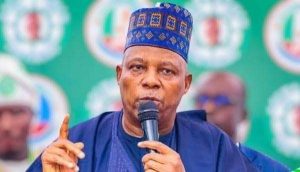

EFCC Goes After Bola Tinubu For Corruption, Writes CCB For Ex-Lagos Governor’s Asset Documents | GOVERNMEND

The EFCC has requested Bola Tinubu’s asset declaration documents from the Code of Conduct Bureau, Peoples Gazette can report, in a politically-charged inquiry that could see the former Lagos governor and ruling party chieftain arrested and prosecuted before 2023.

The anti-graft office in November 2020 asked the asset fraud investigation office to supply details of Mr. Tinubu’s asset documents as part of an ongoing probe of the politician, according to a copy of the request obtained by the Gazette. The request, dated November 6, was a follow-up to previous demands made with respect to Mr. Tinubu’s asset filings.

In the letter, the EFCC referred to its previous letter of September 4, 2020, and CCB’s response of October 9, 2020, asking the bureau to supply “outstanding requested information of Bola Ahmed Adekunle Tinubu.” It was not immediately clear whether or not the CCB has obliged the EFCC’s request for additional information ever since, or the nature and scope of information provided if applicable.

Credit: PressExpress